Activities and lessons for teaching students financial literacy

What is Financial Literacy Month?

Financial Literacy Month, celebrated in April, is an annual month-long initiative promoting financial education and awareness. Financial Literacy Month aims to empower individuals to make informed financial decisions that can positively impact their long-term financial well-being. Throughout the month, schools focus on student financial literacy and personal finance topics such as college tuition, student loans, credit scores, interest rates, budgeting, saving, and investing.

Why is it important to teach students financial literacy?

A whopping 53% of high school teachers are seeing concerning levels of financial illiteracy among their students, according to a recent study on the state of economics and personal finance in high schools conducted by Project Tomorrow and Certell. Only 10% of educators said their students are above basic proficiency. Teaching financial literacy can help students gain confidence in their college experience and future careers. Somewhere between “what do you want to be when you grow up” and “what are your plans after high school,” financial reality sets in for our students and can easily deter even our brightest minds. Financial literacy equips learners with the necessary knowledge and skills to manage their finances effectively, both now and in the future. It can also help reduce financial stress and increase financial confidence, which can have positive effects on their mental health and academic performance.

Activities and lessons for teaching students financial literacy

As educators, we can take active steps to play a positive role in future generations through student financial literacy. Keep reading to explore teaching ideas and our collection of Financial Literacy Month activities, lessons, and videos.

New to Nearpod? Teachers can sign up for a free Nearpod account below to access these standards-aligned activities and create interactive lessons. Administrators can schedule a call with an expert to unlock the full power of Nearpod for schools and districts.

1. Start with the topic most relevant to your students now: College

College planning and financial literacy education go hand in hand when teaching high school students. Financial concepts that are the most relevant to students are college tuition, student loans, and budgeting.

Using these three lessons from RaiseMe to help teach students the financial basics of college planning:

- Lesson 1 – Financial Aid Resources: In this lesson, students explore different financial aid types that are available to fund a college education.

- Lesson 2 – Estimate Costs for College: In this lesson, students are introduced to the raise.me platform and the tools they can use to start their college search.

- Lesson 3 – Earning Merit-Based Aid: In this lesson, students learn how to follow specific schools on raise.me and how to apply for merit-based scholarships.

2. Teach the basics of financial literacy

Improving your students’ basic knowledge of financial literacy can help ensure their future well-being.

Start off by teaching students the origins of Financial Literacy Month and how people celebrate it with this lesson. Next, use these free financial literacy lessons and videos covering life skills, math, and student financial literacy:

- Next Gen Personal Finance (NGPF): This 9-week course includes 41 lessons aligned with national standards for personal financial literacy. Teach the entire course to your high school students, or choose one or a few lessons about a topic you’d like to cover. Use this lesson as is or modify it to adjust to your student’s needs.

- Two Cent Interactive Videos: These engaging videos for grades 6-12 put complex financial topics into understandable terms that students can understand and relate to.

- Math Lessons from Council for Economic Education: These lessons for grades 6-12 apply math to real-world scenarios to help students acquire economic and financial knowledge.

For younger students, teach kids the foundations of money management with these lessons:

- Learning Money for Kids – Coins: In this video from Kids Academy for grades K-2, students learn about counting money.

- Dollars & Cents: In this video from Kids Academy for first grade, students learn to count and compare money amounts.

- Economic Choices: In this lesson on goods and services for grades 3-5, students will learn what goods, services, wants and needs are, and explore why people may choose to spend or save money.

3. Use engaging student financial literacy activities

Once you’ve covered the basics of financial literacy and college planning, use engaging formative assessment activities to understand what they’ve learned.

Here are some fun financial literacy activities you can use in your lesson plans:

- Managing Credit (Grades 6-12): In this financial literacy activity, students will show their understanding of managing credit with Nearpod’s interactive quiz game, Time to Climb.

- Personal Finance (Grades 9-12): In this Time to Climb activity, students will review aspects of personal finance.

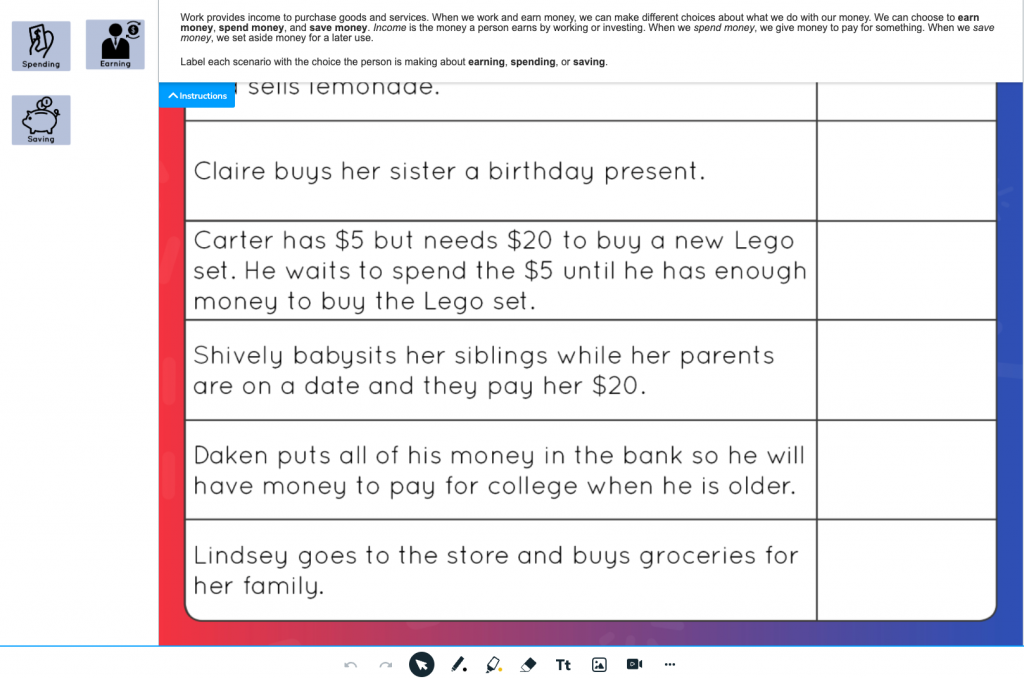

- Earning, Spending & Saving (Grades K-2): In this Social Studies Drag & Drop activity, students will read scenarios and determine if the person is earning, spending, or saving money, helping them understand basic concepts for building financial security.

- Spending & Saving (Grades K-2): In this Matching Pairs activity, students strengthen their understanding of money. They complete a vocabulary challenge by matching key terms to a picture.

4. Make real-world connections to scholarships

- Invite back former students: Who better to express to juniors and seniors just how important the ACT is to pay for college? Who better to talk about how the ACT ties into scholarships? Students who are fresh out of high school and willing to discuss their own journey can help empower students who feel as though their situation is hopeless. Even more importantly, they can help establish a network for students within a larger community.

- Find your success stories: Usually, students with the highest scores are not first-time test-takers, so let them talk about the different strategies they’ve put into place between tests. Whether they’re simply talking about how they studied or managed their time, current students have the most solid connection to the test.

- Use your experiences as learning moments: On ACT score day, give students the nudge they need to keep trying to shoot for their best when their test scores aren’t at the level they want them to be. Silence the negative voice of “just enough” for them and connect them with additional options for test support.

5. Make time year-round for financial literacy and college planning

Students need to learn about college realities early on. Does that mean that we ignore our instructional plans? Never. Does it mean we find innovative ways to squeeze that in? Always.

Here are some ways to make time for teaching financial literacy lessons and activities to use:

- Utilize homeroom time for VR: Many high schools still incorporate some type of homeroom time (or online method) for their students. Incorporate some of Nearpod’s virtual reality (VR) college tours so students can visit different campuses. Explore our video lessons with The College Tour.

- Find teachable moments through advertising: As your students receive information from colleges nationwide, incorporate topics such as rhetorical analysis, marketing, presentation of information, etc., to help them make their decisions.

- Encourage students to reflect and ask for help: As students take ACT and SAT practice tests, it’s crucial for them to feel comfortable sharing their areas of concern to receive active support. In this Learning Through Reflection lesson, students consider how to use reflection as a learning tool.

Start teaching with these financial literacy activities

We’re excited for you to use these resources and tips in your classroom for Financial Literacy Month and year-round. By instilling financial literacy skills at a young age, students can learn the value of financial responsibility and gain the confidence needed to make informed financial decisions throughout their lives. Happy Financial Literacy Month!

New to Nearpod? Teachers can sign up for a free Nearpod account below to access these standards-aligned activities and create interactive lessons. Administrators can schedule a call with an expert to unlock the full power of Nearpod for schools and districts.

Amanda Clark is a fifth-year Nearpod Certified Educator who employs digital tools daily in her English classroom. She believes that incorporating a variety of technology encourages students to branch out of their comfort zone and become more equipped for life after high school. She is currently teaching for Blount County Schools, a district where each high school is currently 1:1.